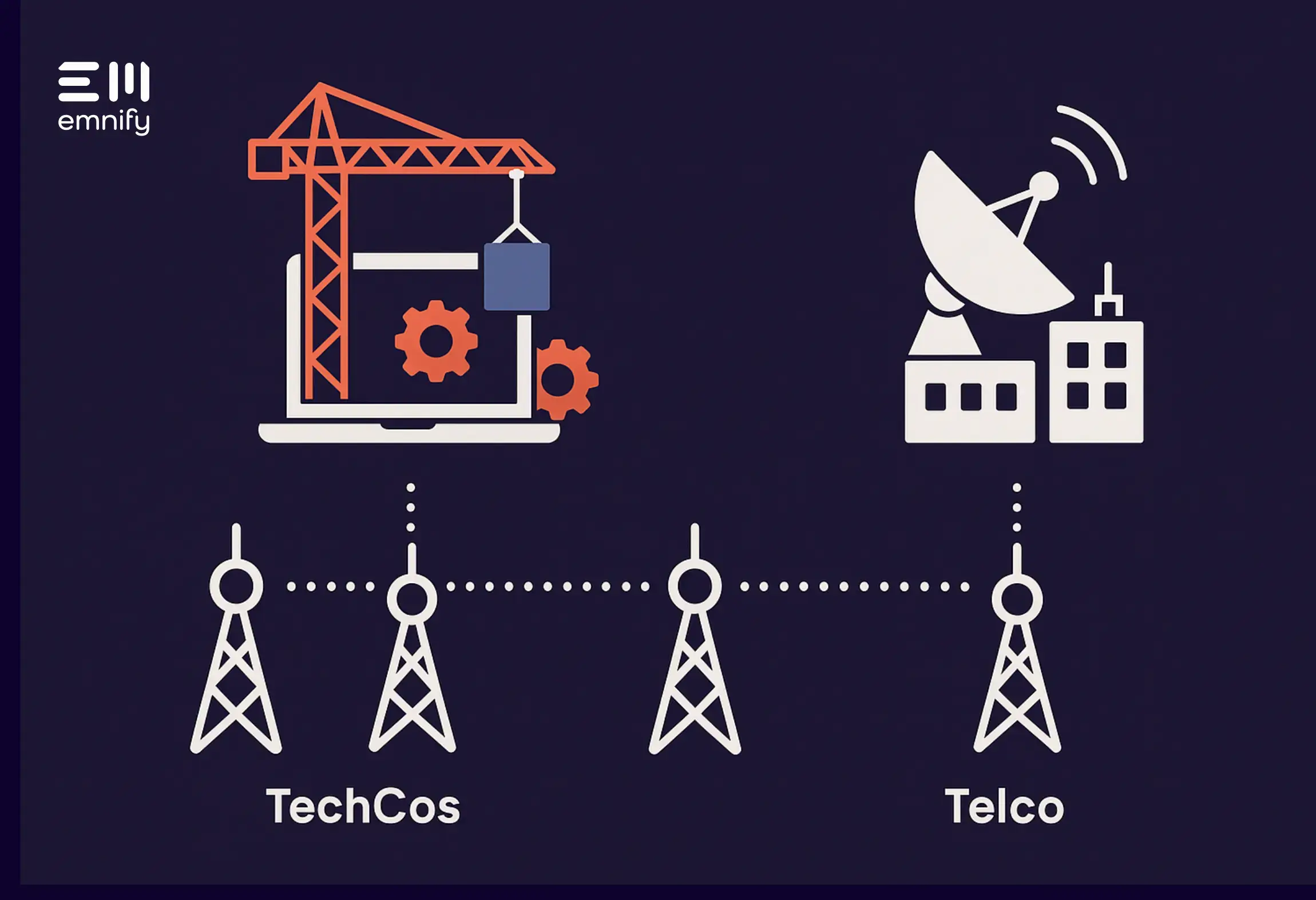

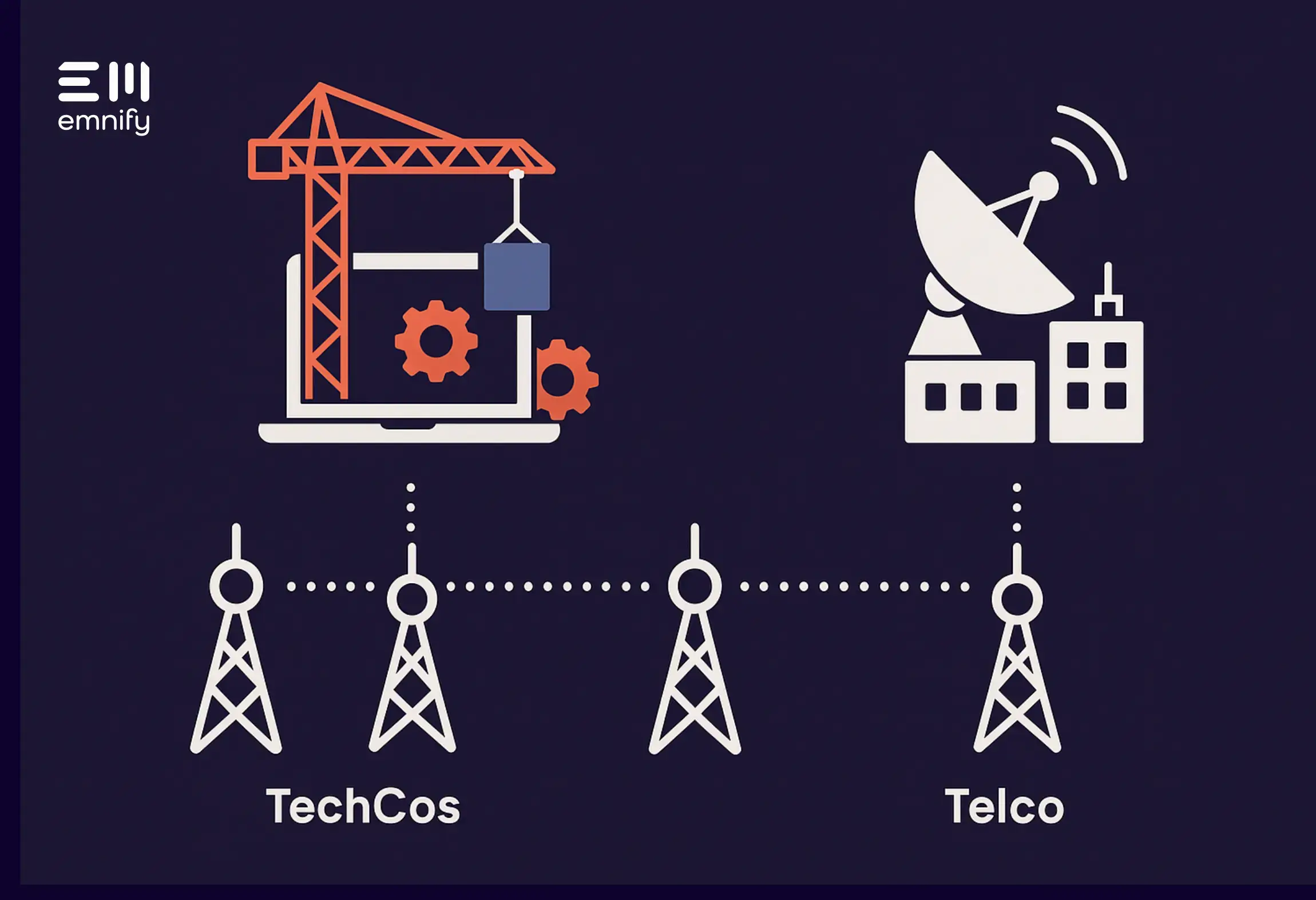

The gap between technology companies (“TechCos”) and traditional telecommunications companies (“Telcos”) is widening. What sets TechCos apart from Telcos today isn’t the networks they run, it’s what they’re building on top of them.

While hyperscalers and digital-native players continue to capture most of the growth through software, platforms and data-driven services, many Telcos remain stuck. They invest heavily in infrastructure but struggle to create new sources of value beyond connectivity.

This divide is even more visible in IoT, where connectivity is treated as a commodity and real value goes to those building and running the platforms above it. To stay relevant in the next wave of digital transformation, Telcos need to move beyond selling bandwidth. They must rediscover how to build; developing software, platforms and tailored digital services that extend well beyond the SIM card.

The TechCo Playbook: Own the Platform, Own the Value

TechCos like Amazon, Microsoft, Google and newer IoT startups follow a straightforward approach:

- Build platforms for data, AI, device management, security and billing

- Attract ecosystems of developers and partners

- Monetize through recurring services, upsells and new business models

This is why AWS is more than a cloud infrastructure provider - it’s an innovation engine. Or why Apple’s revenues go beyond hardware to include services, subscriptions and ecosystems.

In IoT, TechCos are delivering end-to-end platforms that handle device onboarding, data collection, analytics, security and AI. They make it easy for enterprises to deploy IoT at scale, hiding the complexity of networks underneath.

The result? Whether it’s NB-IoT, LTE-M, 5G or fiber, connectivity becomes invisible to the end customer. It’s a cost line, not a strategic advantage.

The Telco Dilemma: Stuck Selling the Pipe

Most Telcos focus on infrastructure. They’ve spent billions rolling out 5G, IoT-specific network slices, private networks and nationwide coverage.

Too often, that’s where innovation ends. IoT connectivity is sold as a commodity: cents per MB, dollars per SIM. Meanwhile, the real value: platforms, dashboards, analytics and insights, goes to others.

This makes Telcos vulnerable to becoming wholesalers in the IoT value chain, while TechCos and industry specialists own the customer experience.

Why Telcos Need to Build Again, Especially in IoT

To stay competitive, Telcos must shift from being connectivity providers to platform builders and solution orchestrators. Here's why doing actual software and product development is critical.

- IoT Needs More Than Connectivity

Enterprises want outcomes, not data pipes. They want to track assets, cut energy use, predict maintenance and improve safety. That requires data platforms, AI and vertical applications — areas Telcos can lead if they commit.

- Own the Customer Relationship and the Data

Selling only connectivity leads to transactional relationships. Offering platforms or industry-specific solutions makes Telcos strategic partners and lets them use the data flowing through their networks to create more value.

- Stand Out in a Crowded Market

If every Telco resells the same IoT management software, there’s no differentiation. Building unique digital tools, local offerings or customizable platforms creates loyalty and pricing power.

- Tap into New Revenue Streams

By owning the platform, Telcos can charge for device management, analytics, SLA-based services, cybersecurity and more — moving beyond per-MB pricing.

What Building Actually Looks Like

Not every Telco needs to become Google. But they do need to develop internal capabilities around product development:

- Hire product managers, engineers, UX designers and data scientists

- Use modern tools: cloud-native architecture, microservices, open APIs and AI libraries

- Build modular IoT platforms that work across industries

- Support developers with clear APIs, sandbox tools and documentation

- Embrace agile methods and iterate based on user feedback

The Stakes Are High

As billions of devices connect from smart meters to autonomous robots, IoT will form the backbone of industries and cities. The key question:

- Will Telcos use their network expertise to become end-to-end solution providers?

- Or will they remain infrastructure players while others reap the rewards?

It comes down to one thing: whether they choose to build.

Final Thought

Telcos already have trust, scale and infrastructure. What many lack is the mindset and skill set to create software products and differentiated platforms.

But if they start now by investing in development teams and building distinctive IoT solutions, they can capture significant value.

At emnify, we’ve built our platform with the same mindset—giving businesses the speed to scale and the control to manage connectivity on their terms. Curious what that looks like? Explore our product demo.

Let’s talk strategy and success stories. Get in touch with us today.

Martin Giess is co founder and founding CTO of emnify, where he oversees the technical execution of emnify’s product vision. He has 15 years’ experience as a technology expert in agile development of innovative telecom services. Before founding emnify, he held technical VP positions at Syniverse and MACH.